Budgeting and Communications

Do you dread the question “What’s Aviation’s Budget-to-Actual last month and year to date?”

As a business aviation leader, you are running a service business within a larger enterprise or high-net-worth family operation. That means you are responsible for overseeing the aviation organization’s finances with the same level of precision with which the aircraft are flown and maintained.

So, you must not only know what your numbers are, but you must also understand the financial drivers that most significantly influence fiscal results. And how to speak to them.

It’s vitally important to report to your Aviation Reporting Executive (ARE) having anticipated his/her bottom-line concerns. That means having both forethought and being brief.

OK, let’s role play. This is your ARE and he/she is asking: “how did Aviation do this last fiscal period?”

Good news! You needn’t to rely solely on Accounting for the information. You have probably been keeping a rough tally on both your fixed and variable expenses throughout the month and year-to-date.

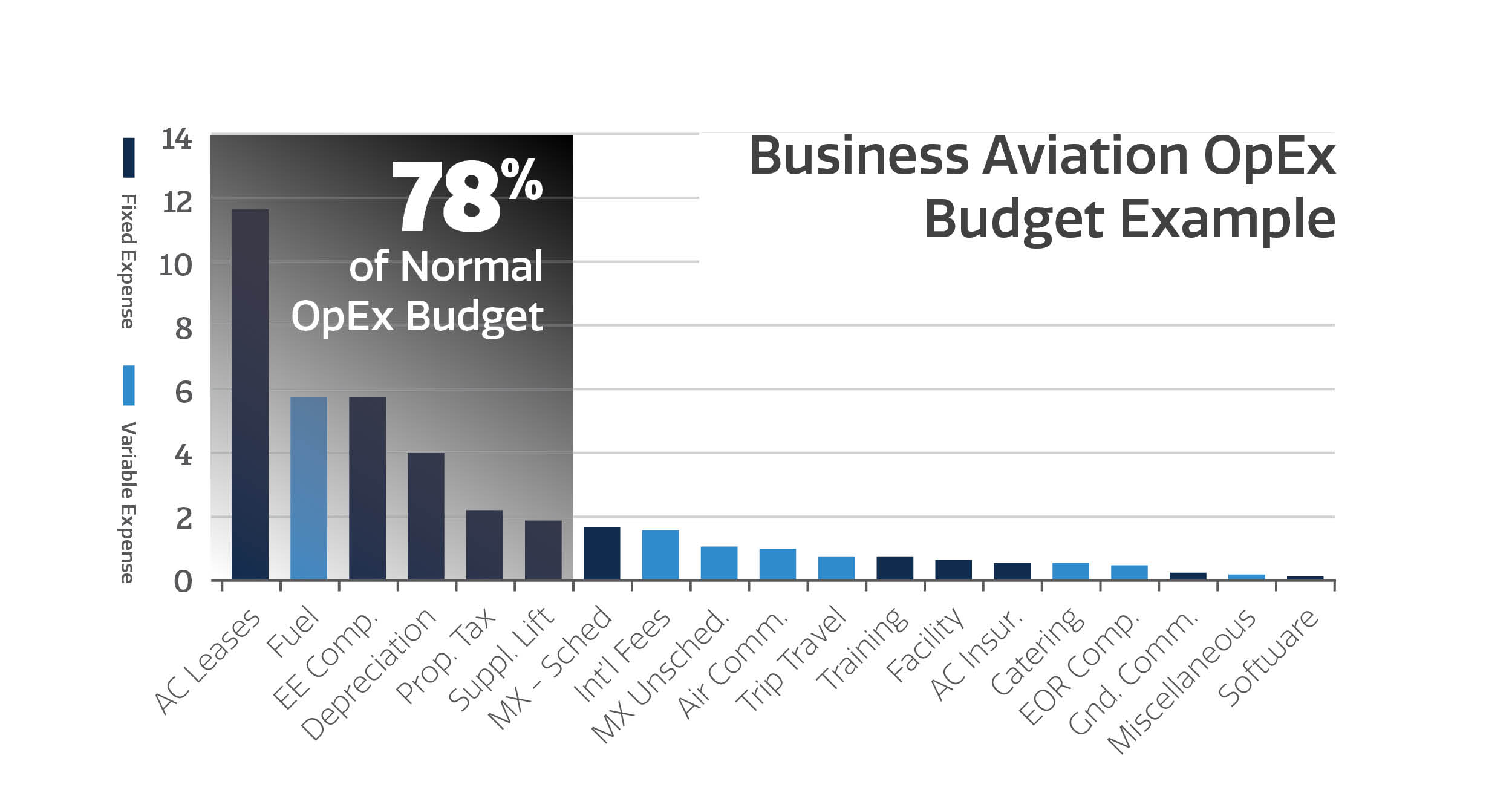

An example of a fixed expense is an Aircraft Lease. Fuel, on the other hand, is a variable expense, with the principal driver being hours flown. Now total up the value of your fixed expenses and your variable expenses. It’s very common to find that about 70% of all monthly expenditures are fixed. Managers don’t like to hear that, but there it is!

Here’s how that knowledge impacts what you’ll convey to the ARE.

Every month, you start with 70% of the answer (all of your fixed expenses.) The variable expenses are generally a result of flight activity. You know how many hours you’ve flown throughout the month, right? Then you can approximate what you will see when accounting issues their monthly report. You’ll pretty much know where you stand instantaneously at month end!

Are you going to be precise to the penny? Probably not. But your boss likely just wants an approximation anyway.

Don’t say: “We need to wait for the financial report before we will know.” The reliable manager will anticipate this perpetual concern and be prepared with a brief ballpark answer.

Can You Really “Do More with Less?”

Well, congratulations, you fielded the question “How did Aviation do last fiscal period.” You kept it brief and to the point. Then the gauntlet is thrown. You are asked to “do more with less.” Is that possible? The answer is a definite maybe.

In many industries, innovation in Operations can produce significant savings. Unfortunately, in Aviation, that doesn’t generally apply.

Can you burn less fuel while flying the same number of hours at the same Mach number? No. Can you fly the aircraft with 1.8 crew members instead of 2? No.

You can well expect you’ll be asked to cut costs. It’s just the nature of the managerial beast.

So . . . How to Take Out 10%?

What do you do when you are asked to take 10% out of your budget? First, start with quantifying the variable vs. fixed expenses.

As an example, if you have a $10M annual OpEx budget, a 10% reduction would be $1M. Assume that the variable portion of your budget is 30% ($3M.)

Now, can you realistically reduce your variable expenses by $1M when you only have $3M to start with? The answer is probably not. That is, unless your flight hours are significantly reduced.

If you can’t find the savings in the variable cost area, then take a look at your fixed expenses. You have a couple of paths to follow:

Make major structural changes. You can modify your personnel headcount and/or the number of aircraft that you are operating.

This means making a permanent change to your fixed cost structure. These changes are generally very difficult to make and incur upfront costs (severance, lease termination fees, etc.)

Make significant operational changes. You can change the way the department operates. For instance, recurrent training programs can change from six to nine months, or you can curtail the use of Supplemental Lift.

Again, these will be changes to the way in which your department and the company (as a whole) have become accustomed to operating. These types of change are not easy!

Know Your Numbers Every Day of the Year

Once you identify all of your expenses, put them in order, from largest to smallest. For instance, Aircraft Leases may be your largest expense item, Fuel may be next, Employee Compensation may be third …and so forth.

When communicating with your ARE or business partner from Accounting, it’s helpful to portray the expenses in a graphical format (as shown.)

Know What Is an Acceptable Variance

What’s an acceptable variance range (i.e., budget vs. actual)? That answer varies with each corporation.

In many mature organizations, the answer is no unapproved spending over budget. And don’t be more than 10% under budget.

Our best advice yet: when you are anticipating deviations and obtaining approvals for them, focus on the assumptions rather than the raw numbers. That will make it a more collaborative effort between you and your ARE.

Signify what the numbers MEAN. Involve the ARE in your assumptions.

So in the end, Budgeting and Communication is about being brief in your reports, yes, and up to speed with the numbers, yes, but also ultimately collaborative in your interactions with your boss. He/She will trust that you know your numbers hands down and will dig in with you to find levers for savings and for improvements. If you share your assumptions.

Remember, if you can’t keep score, you’re at risk. The good news is that these basic accounting principles are the same whether you’re responsible for a one-aircraft operation or a large fleet of aircraft.

Make the commitment to study up on your Aviation Budgeting 101. Know your numbers each and every day. And the assumptions and implications behind them.

Need help with your aviation budget? Learn about our service, Budget Builder™. It’s detailed in this 2-sided PDF, which itself provides valuable information, even if you don’t make the call to Jim Lara for further support!

BTW: That number is 865-357-5077 if the time is now.